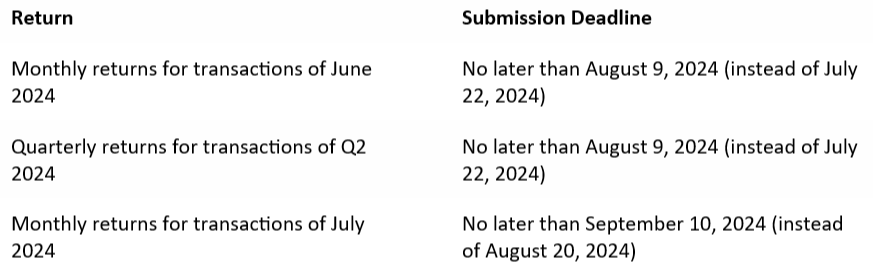

VAT Returns

You may submit your returns by the following dates:

Exceptions apply to:

- holders of a permit for monthly VAT refunds

- beneficiaries of accelerated monthly VAT refunds under the starter status

In these cases, if you are entitled to a VAT credit refund, you must submit your return:

- no later than July 24, 2024, for June 2024 returns

- no later than August 24, 2024, for July 2024 returns

Your bank details must be known at the time of the current account closure. If the account number for VAT refunds is not known to our services, the credit will not be refunded but automatically carried over to the next period.

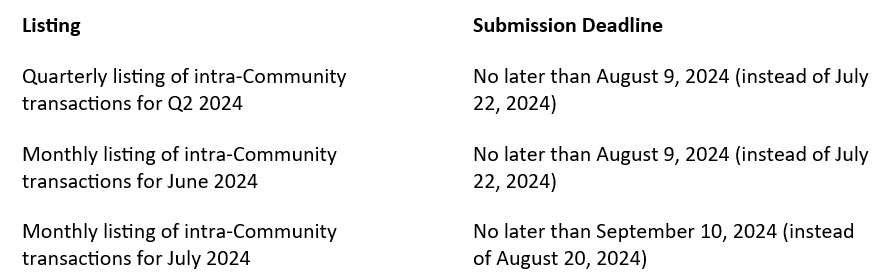

Intra-Community Listings

You may submit your listings by the following dates:

Payments

You must still pay the due VAT by the normal due dates, specifically no later than July 22, 2024 (for the return of Q2 2024 or June 2024) and no later than August 20, 2024 (for the return of July 2024).

If you have not paid the full amount owed by any of these due dates, your current account will be debited with late payment interest. We calculate this in accordance with the provisions of the VAT Code (Article 91, § 1): interest is calculated per month of delay on the owed amount at an annual interest rate of 8% (a started month counts as a full month). Late payment interest for a month is only charged if it amounts to at least 5 euros.

The payment that must be made for one of the aforementioned due dates may, of course, be reduced by the amount of the available credit balance in the taxpayer's current account on that date.

The tax credit that meets the conditions of Article 8/1, § 2 of Royal Decree No. 4 to be refunded at the end of July should not be considered as available.

Source: Uitstel voor btw-plichtigen - zomervakantie 2024 | FOD Financiën (belgium.be) (in Dutch) - Report des délais pour les assujettis à la TVA - Vacances d’été 2024 | SPF Finances (belgium.be) (in French)